HOME

ProRealCode Bykov Trend: Mastering Market Movements with Powerful Trend Analysis

In the fast-paced world of financial markets, where price movements are both opportunities and risks, traders crave tools that are smart, fast, and reliable. Enter the ProRealCode Bykov Trend—a visually simple yet strategically powerful trend indicator. When combined with ProRealCode Bykov Trend, the scripting backbone of the ProRealTime trading platform, it transforms into an unstoppable trend-tracking force.

Whether you’re trading Forex, indices, stocks, or crypto, understanding and mastering the ProRealCode Bykov Trend strategy can help you not just ride the waves—but predict them.

What is ProRealCode Bykov Trend and How Does It Empower Traders?

ProRealCode Bykov Trend is the scripting and strategy-building interface of ProRealTime, a charting software loved by technical traders. It allows users to build, test, and deploy custom indicators and trading algorithms in a language called ProBuilder.

From moving averages to sophisticated AI-powered strategies, ProRealCode unlocks your trading potential. And when you plug in Bykov Trend—magic happens.

Understanding the Bykov Trend Indicator

Originally developed by Vladimir Bykov, the Bykov Trend is a momentum-based trend-following indicator. Unlike lagging tools like moving averages, Bykov reacts swiftly to price changes and plots clear signals.

It highlights trend shifts using color-coded candles or histogram bars, often paired with moving averages or volume filters. The result? Fewer false signals and stronger conviction.

The Core Principles Behind Bykov Trend

The Bykov Trend operates on these fundamental principles:

-

Momentum Detection: Uses rate-of-change or smoothed oscillators

-

Trend Color Coding: Green = Bullish, Red = Bearish

-

Dynamic Filtering: Filters out noise in choppy markets

-

Breakout Readiness: Prepares traders for strong entry setups

Its ability to simplify complex data into easy-to-read signals is what makes it perfect for visual traders and algorithmic systems alike.

Using Bykov Trend with Automated Strategies

ProRealCode enables you to automate the Bykov Trend into a fully functioning algorithm. Imagine:

-

Auto entry on green bars

-

Stop-loss at ATR levels

-

Take profit based on risk-reward ratios

Bykov Trend integrates beautifully into any ProOrder strategy, eliminating emotion and hesitation.

Which Markets Can Benefit from Bykov Trend?

The best part? It’s multi-market and multi-timeframe. Use Bykov Trend on:

-

Forex pairs like EUR/USD or GBP/JPY

-

Indices like DAX, NASDAQ, or S&P 500

-

Cryptos such as BTC/USD or ETH/USD

-

Commodities including gold and oil

As long as there’s price action, Bykov Trend has you covered.

The Clean Interface That Boosts Decision Making

Unlike overcomplicated indicators, Bykov Trend thrives on simplicity. Most visual implementations use:

-

Color-coded bars or lines

-

Clear signals with arrows or labels

-

Overlay on price chart or separate window

This clean look reduces cognitive load, making trading decisions faster and more confident.

How Accurate Is the Bykov Trend in Real-Time?

Accuracy depends on market conditions, but many traders report:

-

Win rates of 60-70% when combined with filters

-

High-probability breakout detection

-

Strong trend continuation insights

Its strength lies in early trend detection and exit confirmation, keeping you on the right side of price movement.

Adapting the Indicator to Scalping, Swing, and Day Trading

Bykov Trend adapts easily to your trading style:

| Style | Recommended Timeframe |

|---|---|

| Scalping | 1-min to 5-min charts |

| Day Trading | 15-min to 1-hour charts |

| Swing Trading | 4-hour to Daily charts |

Simply adjust the smoothing or momentum settings for optimal performance.

How to Modify Bykov Trend in ProBuilder Code

Want to tweak it? Use ProBuilder, ProRealTime’s custom coding interface. You can:

-

Adjust momentum periods

-

Set bar colors and transparency

-

Add volume or RSI filters

-

Incorporate divergence detection

Coding tip: Always use ‘defparam’ to control signal behavior and backtest range.

Installing the Bykov Trend Indicator on ProRealTime

Follow these simple steps:

-

Go to ProRealCode.com

-

Search for “Bykov Trend”

-

Copy the ProBuilder code

-

Open ProRealTime → Indicators → New

-

Paste the code and save

-

Add to your chart

Voila! You’re ready to trend like a pro.

Buy and Sell Signals: How They Work

Most Bykov scripts generate signals like:

-

Green Arrow Up = Buy Signal

-

Red Arrow Down = Sell Signal

-

Gray Bar = No Trade/Neutral Zone

Many users use these signals to trigger alerts, orders, or additional filters.

Does Bykov Trend Repaint? Why It Matters

Most quality ProRealCode versions of Bykov Trend are non-repainting, meaning signals don’t change retroactively. This ensures reliable backtesting and strategy deployment.

Always check the code for repaint functions or delayed signal adjustments before going live.

Fine-Tuning Settings for Better Market Entry Points

Key adjustable settings include:

-

Momentum period (usually 14 or 21)

-

Smoothing factor (Exponential or Weighted)

-

Confirmation delay (use 2-3 bars after crossover)

-

Volume filter (optional)

Use ProRealTime’s optimization tools to backtest multiple combinations.

Backtest Your Bykov Strategy Like a Pro

ProRealTime’s ProBacktest engine allows you to test Bykov strategies using:

-

Entry/exit rules

-

Stop-loss and take-profit parameters

-

Capital allocation per trade

-

Drawdown management

Review metrics like:

-

Win rate

-

Profit factor

-

Sharpe ratio

-

Maximum drawdown

Bykov Trend Across Platforms: TradingView vs ProRealTime

While Bykov Trend scripts exist on TradingView, ProRealTime offers:

-

More robust backtesting

-

Custom automation (ProOrder)

-

High-quality historical data

-

Broker integration (IG, Interactive Brokers)

For serious algo traders, ProRealTime is hard to beat.

The Trader’s Mindset When Using Trend-Following Tools

Success with Bykov isn’t just technical—it’s psychological.

-

Trust the trend

-

Avoid overtrading

-

Stay patient during consolidation

-

Use alerts, not anxiety, to manage trades

Discipline turns indicators into income.

Combining Bykov Trend with RSI, MACD, and EMAs

For added confirmation:

-

Use RSI to avoid overbought entries

-

Use MACD crossovers for momentum confirmation

-

Use EMAs for dynamic support/resistance

Example entry: Buy when Bykov is green and MACD crosses above signal line.

How to Reduce Whipsaws with Confirmation Indicators

Whipsaws = the nemesis of trend traders.

To avoid them:

-

Add ATR filters to avoid low-volatility chop

-

Use volume spikes to validate breakouts

-

Confirm with multiple timeframe alignment

Always test before trusting a new signal combination.

Position Sizing and Stop-Loss Settings with Bykov

Smart traders don’t risk it all.

Use:

-

1-2% risk per trade

-

ATR-based stops

-

Trailing stops during strong trends

-

Break-even rules after 1:1 RR is hit

Money management is the real secret sauce.

Real Trade Examples Using Bykov Trend on Forex

Let’s say:

-

EUR/USD on 1-hour chart

-

Bykov Trend turns green

-

MACD confirms uptrend

-

ATR stop = 30 pips

Result?

✅ Entry at 1.0950

✅ TP at 1.1050

✅ SL at 1.0920

✅ RR = 3.3

✅ Profitable with clear trend guidance

Win Rate, Risk-Reward Ratio, and Profit Factor

Typical metrics:

-

Win rate: 60-70%

-

RR: 2:1 or higher with filters

-

Profit factor: 1.5 to 2.5

-

Drawdown: Under 15% with proper controls

Solid stats for swing and day traders alike.

How Bykov Performs in Trending vs Ranging Markets

Bykov thrives in trends but struggles in choppy sideways moves. During ranges:

-

Use range filters

-

Lower position size

-

Switch to oscillators like RSI or Stochastic

Adaptability is key.

Editing the ProBuilder Script for Advanced Users

Modify to add:

-

Multi-timeframe logic

-

Signal buffers

-

Email/Push notifications

-

Trade management rules

Advanced coders can turn Bykov into a full expert advisor.

Creating Automated Alerts for Buy/Sell Signals

ProRealTime lets you create:

-

Desktop alerts

-

Email notifications

-

Mobile push alerts

Trigger alerts on:

-

Bar close

-

Crossovers

-

Indicator zone entries

Learning from ProRealCode Forums and Experts

Join the ProRealCode community to:

-

Download top-rated Bykov versions

-

Get feedback on your scripts

-

Learn from master coders like Nicolas and JS

The forums are full of gold—for free.

Does Bykov Trend Work on ProRealTime Mobile?

Yes, but with limited functionality:

-

View signals

-

Monitor trades

-

Get alerts

But coding and optimization are best done on desktop.

Pitfalls to Avoid with the Bykov Indicator

-

Don’t use it alone. Confirm with other tools.

-

Avoid high-impact news events. They distort signals.

-

Don’t trade every signal. Be selective.

Bykov is powerful—but not foolproof.

Responsible Use of Algo Trading Tools

Regulated brokers and responsible trading matter.

-

Use demo accounts first

-

Understand local regulations

-

Never risk more than you can afford to lose

-

Avoid black-box strategies promising “guaranteed profits”

Final Thoughts: From Code to Cash with Bykov Trend

The ProRealCode Bykov Trend strategy is more than just an indicator—it’s a blueprint for smarter trading. Whether you’re coding bots or scanning for breakouts, this tool adds clarity, confidence, and consistency to your game.

HOME

Giniä: Understanding Its Meaning and Relevance

Introduction

The word giniä is not widely recognized in mainstream English, but it resembles terms that may appear in linguistic, cultural, or conceptual contexts. While it is not a standard term in dictionaries or scientific literature, its usage or appearance could relate to specific brands, personal names, cultural references, or even creative designations. This article explores possible meanings and interpretations of giniä, its linguistic features, and potential relevance in modern discourse.

The Linguistic Structure of Giniä

Analyzing the Word Form

At a glance, giniä appears to be a word constructed with a base (gini) and a diacritic mark (ä). The umlaut (¨) over the letter “a” suggests that the term may be influenced by languages such as German, Finnish, Estonian, or Swedish, where vowels with diacritical marks carry specific phonetic meanings.

In those languages:

- Words ending in -ia or -iä can indicate feminine forms or pluralities

Thus, giniä may be phonetically pronounced as “gih-nee-ah” or “gih-nee-eh”, depending on the language base.

Possible Language Origins

The word could have origins or usages in:

- Finnish, where “-ä” endings are common in partitive cases

- German, where “ä” changes pronunciation and meaning

- Constructed or brand names, designed to sound elegant or international

The creative use of the umlaut also makes it popular in branding or artistic contexts to create a unique and stylized term.

Possible Interpretations of Giniä

Given the versatility of made-up or regionally adapted words, giniä might be interpreted in several plausible ways.

1. A Brand or Product Name

Many brands today create names that are memorable, global, and culturally neutral, using stylized characters to stand out. Giniä could be a brand name for:

- A cosmetic or skincare product emphasizing natural or luxurious qualities

- A fashion label aiming for a European aesthetic

- A digital app or startup in wellness, AI, or design

In this case, giniä serves as a trademark-friendly term, possibly linked to values like clarity, sophistication, or innovation.

2. A Personal or Fictional Name

The name Giniä may be used as a fictional character in literature, gaming, or storytelling. It evokes a futuristic or mythological tone, making it a strong candidate for:

- Science fiction or fantasy characters

- Virtual assistants or AI personas

- Protagonists in indie games or novels

It may also function as a given name in fictional or multicultural contexts.

3. Cultural or Artistic Symbol

If giniä is used in an artistic context, it might represent a concept or idea. Artists, musicians, and designers sometimes invent names to signify a project or movement. For instance, giniä could be:

- A term representing feminine energy or intuition

- A symbol in abstract visual art

This type of name is designed to evoke emotion or provoke curiosity.

How Giniä Could Be Used in Business or Design

Branding Potential

One of the key attractions of the term giniä is its international appeal and visual uniqueness. The use of the diacritic makes it stand out in digital and printed formats. It’s short, easy to remember, and not tied to any specific known word, which makes it versatile in:

- Global brand naming

- Luxury product lines

- Minimalist or Nordic-inspired visual identities

Domain and Trademark Availability

Because it is an uncommon term, giniä may still be available as a domain name or trademark, making it ideal for startups looking for a unique brand presence online. Names like giniä.com or giniä.app would be desirable for companies focused on elegance, clarity, or simplicity.

Logo and Visual Representation

The shape and balance of the word “giniä” allow for strong visual design. Brands using it could emphasize clean lines, modern fonts, and stylish colors, consistent with Scandinavian, German, or Japanese minimalism.

Giniä in the Context of Language Creation

Some modern authors and game developers engage in conlanging—the creation of fictional languages. Words like giniä may originate in:

- Constructed language dictionaries

- Role-playing worlds

- Digital environments or metaverses

These invented words follow consistent grammar rules and often gain popularity through cultural adoption or viral storytelling.

Why Words Like Giniä Matter

Terms like giniä, while not yet defined by global consensus, reflect key trends in:

- Creative branding

- Multicultural fusion

- Phonetic aesthetics

- Digital identity

Understanding how and why such words emerge helps linguists, marketers, and content creators stay ahead of language evolution and cultural branding.

Conclusion

Though giniä does not yet have a universally accepted definition, it holds promise as a creative, flexible, and globally appealing term. Whether it becomes a brand name, a fictional character, or a linguistic innovation, giniä demonstrates the power of constructed vocabulary in a connected, creative world.

HOME

Transform Your Backyard into a Relaxation Oasis

Envision stepping out into your backyard and being instantly transported to a serene retreat, a space that feels like an escape just steps away from your door. With a bit of thoughtful planning and inspiration, turning your outdoor area into a personal sanctuary is easier than you may imagine. Whether you seek a tranquil spot to unwind after a long day or an inviting area to gather with friends, the process begins with purposeful design and a clear vision. For those considering water features or luxury enhancements, expert pool design and planning Orange County can be an integral part of achieving your oasis dreams.

Transforming your backyard is not only about adding furniture or plants. It’s about curating a setting that supports your lifestyle and brings you a sense of peace. Consider the moods you want to evoke and the functional needs you have. The right changes will make your space both attractive and deeply relaxing, while also adding value to your home.

When planning your backyard oasis, start by establishing zones for different uses, such as a dining area, a restful nook with a hammock, or a place for meditation. Layering in elements like greenery, soothing sounds, and comfortable furnishings turns an average backyard into a daily retreat. Small details, like the sound of water or the glow from ambient lighting, can make a significant difference.

Define Your Space

Begin by evaluating your backyard’s layout and dimensions. Clearly identifying distinct zones for lounging, dining, or quiet reflection enables multifunctional use without clutter. Use outdoor rugs, tall planters, or garden screens to discreetly segment areas. Creating these visual and physical boundaries can provide purpose while making even small yards feel spacious and organized. This intentional layout not only facilitates relaxation but also maximizes every square foot of your outdoor space.

Incorporate Comfortable Seating

Selecting the right outdoor furniture is essential for relaxation. Opt for weatherproof materials such as teak, powder-coated metals, or all-weather wicker to ensure longevity with minimal maintenance. Plush cushions, ottomans, and hammocks can elevate the comfort level and encourage long hours spent outdoors. Arrange seating in conversational groupings or create a solitary retreat with a hanging chair or daybed for reading and reflection. When possible, invest in modular seating that can be rearranged to accommodate gatherings or intimate moments alone.

Add a Water Feature

The gentle sound of flowing water has a remarkably calming effect and helps mask neighborhood noise. Installing a water element, such as a fountain, small pond, or sleek wall-mounted waterfall, can become a soothing focal point in your landscape. Water features also entice songbirds, butterflies, and other wildlife, enhancing your connection to nature and offering a multi-sensory relaxation experience. Gardening Know How suggests that even a compact feature, like a tabletop fountain, can dramatically transform the ambience.

Install Ambient Lighting

Lighting sets the ultimate mood for outdoor relaxation, extending your enjoyment well after sunset. String lights overhead, solar-powered lanterns hung in trees, and low-voltage path lights all contribute to a soft, inviting glow. Consider layering different light sources to highlight landscape features, illuminate pathways, or cast a gentle shimmer on water. Smart lighting systems that integrate with your devices add convenience, allowing you to personalize brightness and color for any occasion. According to Redfin, proper lighting brings warmth and safety while emphasizing the architectural beauty of your space.

Introduce Lush Greenery

Greenery introduces life, color, and a sense of tranquility to any yard. Select a variety of native plants, flowering shrubs, or ornamental grasses suited to your climate for easy maintenance and year-round interest. Position potted plants along walkways or patios, and tuck fragrant herbs near lounge areas for added sensory appeal. Planting layers, such as groundcover under taller bushes and trees, creates depth within the landscape. Incorporate evergreens for year-round color and prioritize pollinator-friendly flowers to support local ecosystems.

Create Shade

Shade transforms a hot, sun-drenched space into a comfortable haven. Start with classic options like umbrellas, canopies, or shade sails for easy versatility. For a more permanent resort-style feel, install structures such as pergolas or gazebos, draped with breezy outdoor fabric. You can also foster natural shade by training flowering vines on trellises or planting fast-growing shade trees tailored to your region’s conditions. Well-placed shade not only cools the area but also protects furnishings, prolonging their lifespan.

Add a Fire Feature

Fire features add warmth, ambiance, and a striking focal point to outdoor living areas. Freestanding fire pits, sleek fire bowls, and built-in fireplaces provide gathering spots for chilly evenings or lively get-togethers. Select a design that complements your landscape aesthetic and ensure it meets local safety regulations. Fire features can double as cooking areas for roasting treats or simply create a mesmerizing glow that invites relaxation and conversation well into the night.

Personalize Your Space

Infuse your backyard oasis with personal touches that showcase your style and passions. Outdoor art, decorative throw pillows, wind chimes, or a miniature herb garden can define the space as uniquely yours. Incorporate family heirlooms, travel finds, or hand-crafted decor to create an outdoor area that feels like an extension of your home. Personalization deepens your connection to the environment, making your backyard a welcoming retreat for both peaceful solitude and joyful gatherings.

Final Thoughts

Crafting a backyard oasis involves careful planning, creative touches, and an emphasis on comfort and natural beauty. By considering function, aesthetics, and seasonal adaptability, you can create a personalized retreat that offers daily renewal and lasting value.

HOME

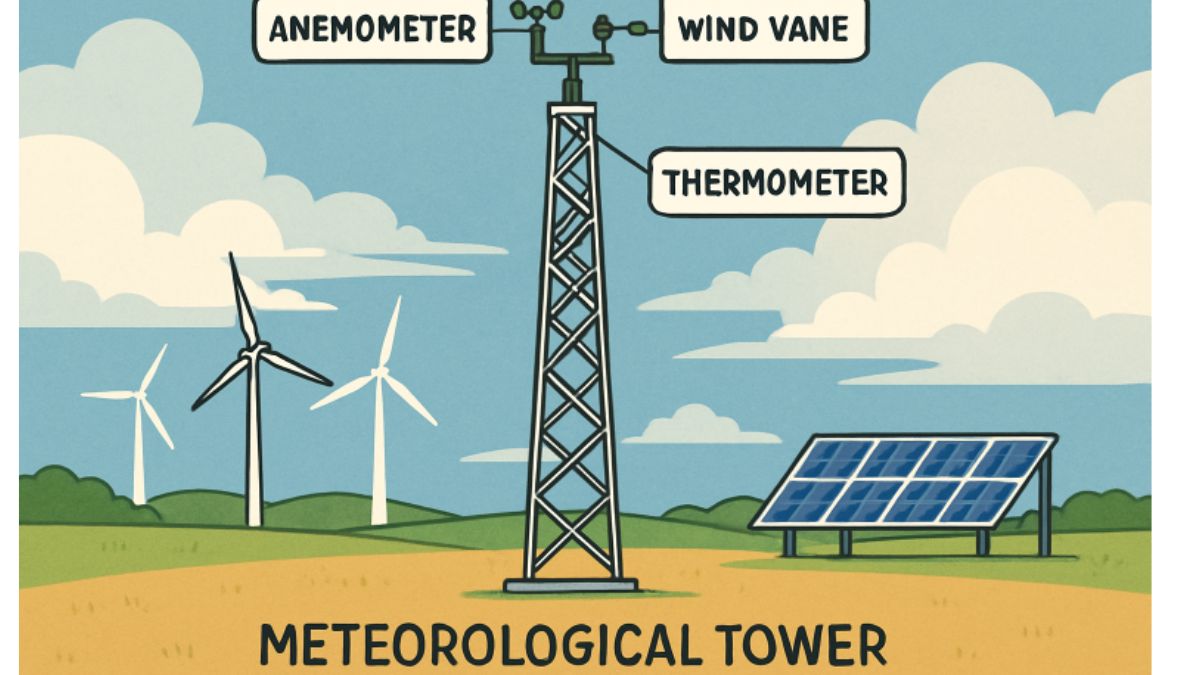

Innovative Applications of Meteorological Towers in Renewable Energy

Meteorological towers, also known as met towers, play an integral role in the development and enhancement of renewable energy projects. These towers are installed to collect accurate meteorological data, which is fundamental for evaluating wind energy potential. For organizations and project developers seeking to optimize renewable energy sites, successful meteorological tower installation can be the critical step between feasibility study and profitable energy production.

The value of these towers extends beyond simply measuring wind speed. They gather comprehensive profiles of atmospheric conditions, including wind direction, air pressure, temperature, and humidity, which contribute to the reliability and efficiency of wind energy systems. With increased demand for sustainable energy sources, the technical and strategic placement of met towers has become a focus of innovation.

Recent years have seen remarkable growth in the use of met towers not only for conventional wind farm planning but also for newer, diversified applications. As climate targets tighten and investment in renewables expands, innovative approaches to harnessing wind and solar power have surfaced. This has driven advances not just in turbine technology but also in the structures that support and inform them.

Beyond wind assessment, meteorological towers have begun to integrate with various renewable energy systems. As global leaders invest in greener infrastructure and urban environments become more energy-conscious, the design and implementation of these towers continue to evolve into addressing novel environmental and operational challenges.

Role of Meteorological Towers in Wind Energy

Meteorological towers are foundational for wind energy project development. By delivering real-time, precise data on wind speed and variability, they enable site developers to assess the quality and consistency of wind resources at prospective turbine locations. This influences every stage of a wind project, from the initial feasibility study and turbine selection to site layout and ongoing performance monitoring. Data accuracy impacts millions in investment and long-term reliability, making these towers a necessity for energy companies and engineers alike. For a thorough review of modern wind data methodologies, see how the U.S. Department of Energy evaluates wind resource measurement.

Advancements in Meteorological Tower Design

Innovation is reshaping how meteorological towers are designed and utilized. Novel concepts, such as vortex engines, are being explored to reimagine traditional infrastructure models. These systems replace tall chimneys with engineered air vortices that replicate natural weather phenomena to lift warm air and generate mechanical energy with a fraction of the footprint. In addition, advances in sensor technology and data transmission enable real-time, remote analytics, increasing the precision and usefulness of data collected by towers in challenging environments.

Sustainability is also driving change in design philosophy. The use of renewable construction materials, modular assembly techniques, and adaptive structural forms all point to a greener, more cost-effective future for meteorological towers in renewable applications.

Integration with Solar Energy Systems

The integration of meteorological towers with solar energy infrastructure marks a significant leap in the efficiency of renewable energy systems. Facilities such as the RayGen PV-Ultra Thermal-Hydro Storage Power Plant in Victoria, Australia, combine high-performance solar arrays with advanced energy storage to deliver grid-stabilizing, dispatchable energy. Here, meteorological towers continuously monitor wind and solar conditions, providing the data needed to fine-tune operational strategies and maximize output. Developments like these are a testament to the growing importance of precise weather data for all forms of renewables. Significant industry insights can be found in PV Magazine’s coverage of Australia’s pioneering solar-hydro storage project.

Urban Applications of Meteorological Towers

Urban centers present unique challenges and opportunities for renewable energy deployment. Traditional wind turbines, with their large blades and space requirements, are often unsuitable for densely populated areas. Here, meteorological towers are supporting innovations such as vortex bladeless wind turbines. These compact, oscillating structures harness wind energy silently and efficiently, making them ideal for rooftop or compact city installations. By equipping these urban turbines with networked meteorological towers, cities can gain valuable insights into microclimates and optimize the integration of renewable energy into municipal buildings and infrastructure.

Case Study: The World’s Largest Wooden Wind Turbine Tower

The inauguration of the world’s tallest wooden wind turbine tower in Skara, Sweden, in March 2024 marked a new chapter in sustainable engineering. At 103 meters tall, this structure supports a Vestas V90-2.0 MW turbine and is constructed predominantly from locally sourced wood laminates. This project not only reduces the tower’s carbon footprint but also showcases how renewable materials can facilitate taller, more productive installations. The design supports greater wind harvesting capabilities while offering a model for future eco-conscious construction in the wind sector.

Future Prospects and Challenges

The continual evolution in the applications of meteorological towers highlights both remarkable opportunities and emerging challenges. While innovations in materials, analytics, and integration pave the way for enhanced sustainability and efficiency, barriers such as high upfront investment, technical skill requirements, and regulatory complexity must be overcome. Environmental considerations, particularly for sensitive sites, demand ongoing research into lighter, more adaptable structures.

Looking Ahead

Expanding the role of meteorological towers in hybrid renewable grids, smart cities, and offshore installations remains a top priority for global clean energy initiatives. As research and cross-industry collaboration intensify, these towers are poised to become an even greater asset in the transition toward a resilient, low-carbon future. The advances being made today will serve as the foundation for the energy solutions of tomorrow.

-

HEALTH2 years ago

HEALTH2 years agoIntegrating Semaglutide into Your Weight Loss Plan: A Practical Guide

-

HOME IMPROVEMENT2 years ago

HOME IMPROVEMENT2 years agoHow to Choose the Perfect Neutral Area Rug for Every Room

-

FASHION2 years ago

FASHION2 years ago7 Celebrity-Inspired Elegant Summer Dresses For 2024

-

LAW2 years ago

LAW2 years agoTeenage Drivers and Car Accidents in California: Risks and Parental Liability

-

CONSTRUCTION2 years ago

CONSTRUCTION2 years agoConstruction Site Safety Regulations in New York and Your Rights as a Worker

-

LAW2 years ago

LAW2 years agoPost-Divorce Considerations in California: Modifications and Long-Term Planning

-

HOME2 years ago

HOME2 years agoSandra Orlow: The Teen Model Who Captivated the Internet

-

FINANCE2 years ago

FINANCE2 years agoDigital Asset Management in Florida Estate Planning