HOME

TraceLoans.com Mortgage Loans: Simplifying Your Path to Homeownership

TraceLoans.com Mortgage Loan—it’s an emotional milestone, a symbol of independence, stability, and achievement. But let’s not sugarcoat it: the process can feel complex and overwhelming, especially when it comes to navigating mortgage loans. That’s where TraceLoans.com Mortgage Loans steps in to simplify the path, turning what could be a daunting task into an exciting step toward your dream home.

Here’s everything you need to know about TraceLoans.com Mortgage Loan mortgage services and how they can make homeownership a stress-free—and dare we say, joyful—experience.

Why TraceLoans.com Mortgage Loan Stands Out

With countless TraceLoans.com Mortgage Loan lenders competing for attention, why choose TraceLoans.com? The answer lies in their customer-first approach and focus on simplifying the entire loan process. Whether you’re a first-time buyer or looking to refinance, TraceLoans.com offers tailored solutions to fit your unique needs.

What makes TraceLoans.com a game-changer?

- Variety of Loan Types: From conventional loans to FHA and VA options, they’ve got a solution for everyone.

- Streamlined Application Process: Their user-friendly platform helps you apply in minutes—no confusing paperwork or unnecessary delays.

- Competitive Rates: With affordable interest rates, TraceLoans.com works to save you money.

- Dedicated Support Team: Real humans ready to guide you every step of the way.

- Educational Resources: Not sure where to start? Their website is a treasure trove of helpful articles, loan breakdowns, and expert advice to build your confidence.

Applications of TraceLoans.com Mortgage Loans

At its core, TraceLoans.com empowers potential homeowners to achieve their goals, no matter their situation. Here’s a quick breakdown of how their mortgage solutions can meet your needs.

1. Making Homeownership a Reality for First-Time Buyers

Navigating the housing market as a first-time buyer can feel like trying to read a map in a foreign language. TraceLoans.com simplifies the process with personalized guidance and resources to help you understand the ins and outs of your mortgage loan. Plus, thanks to their competitive rates and diverse loan options, you’re sure to find something tailored to your financial goals.

“I’d spent months trying to find the right mortgage provider—until I found TraceLoans.com. Their step-by-step guidance and friendly support team made buying my first home a breeze!” — Maria T., TraceLoans.com customer.

2. Convenient Refinancing Options

Already a homeowner but looking to refinance? Maybe you want to reduce your monthly payments, pay off the loan faster, or access equity for home improvements. Through their streamlined refinancing plans, TraceLoans.com helps you rework your existing mortgage into one that better fits your life right now.

3. Support for Buyers with Financial Challenges

Worried your credit score might hold you back? You’re not alone. Millions of Americans face similar challenges. TraceLoans.com specializes in helping individuals overcome bad credit hurdles, offering financial flexibility and expert advice to get you on the right track.

“Bad credit had always been a roadblock for me—until TraceLoans helped me secure a mortgage. Now, I’m living in my dream home, and my financial future is brighter than ever.” — Kevin H., TraceLoans.com customer.

4. Guidance for Complex Loan Needs

Self-employed? Looking for a loan that’s a little less conventional? TraceLoans.com embraces complexity with confidence, offering options that accommodate unique income situations, unconventional loan terms, and tailored repayment plans.

How the Process Works

TraceLoans.com has removed the guesswork from getting a mortgage. The process is as easy as 1-2-3—and yes, we mean it.

Step 1. Apply Online in Minutes

Visit TraceLoans.com and fill out their straightforward application form. No endless forms or outdated systems—just a simple process to get the ball rolling.

Step 2. Get Matched with a Mortgage Specialist

Once you submit your application, TraceLoans.com connects you with a dedicated mortgage consultant. They’ll walk you through next steps, answer your questions, and help identify the best loan option for your situation.

Step 3. Unlock Your Dream Home

With TraceLoans.com streamlining the process, you’ll be celebrating in your new home sooner than you thought possible.

How Borrowers Benefit from TraceLoans.com

The advantages of working with TraceLoans.com are all about you. Here’s what sets them apart from traditional lenders and helps you feel confident throughout your mortgage experience.

- Speedy Approvals: Forget endless wait times; applications are processed quickly so you can focus on what really matters—choosing the perfect curtains for your new living room.

- Transparent Terms: No hidden fees, confusing jargon, or surprise costs. TraceLoans.com ensures every detail is clear.

- Expert Guidance: Whether it’s your first home or your fifth, their specialists explain every detail with patience and care.

- Community Values: With TraceLoans.com, you’re not just another customer—you’re part of their mission to make homeownership accessible to all.

Their customer-first model reflects inclusivity and respect for borrowers at all levels—and their testimonials speak for themselves.

Pro Tips for Mortgage Success with TraceLoans.com

Before applying for a loan, it’s worth preparing to maximize your chances of success. Here’s how you can get started today.

1. Check Your Credit Score

While TraceLoans.com welcomes buyers of all credit levels, a good credit score could help you secure better interest rates.

2. Plan for Your Down Payment

Most conventional loans require at least 3-5% as a down payment. Starting a savings plan today can make all the difference.

3. Gather Your Documents

Get organized by collecting essential paperwork like pay stubs, bank statements, and tax returns ahead of time.

Unlock Your Dream Home with TraceLoans.com

From expertly curated loan options to friendly, dedicated support, TraceLoans.com Mortgage Loan isn’t just a mortgage provider. They’re a partner in your homeownership dream—a team determined to see you succeed.

Your next step? Start your application and get one step closer to unlocking the front door of your dream home.

HOME

Bounce House Rentals in Tampa: The Ultimate Guide to Fun-Filled Parties and Events

When it comes to hosting an unforgettable party or event in Tampa, nothing excites guests quite like Bounce House Rentals. Whether you’re planning a child’s birthday party, a school carnival, a church gathering, or a corporate event, bounce houses deliver hours of fun, laughter, and active entertainment. With a wide variety of see their bounce house options available, it’s easy to find the perfect inflatable to match your theme, space, and budget.

At Bounce Party of Tampa, we specialize in providing clean, safe, and high-quality bounce houses that transform ordinary gatherings into extraordinary celebrations. In this guide, we’ll explore why bounce house rentals are so popular, the types of bounce house options you can choose from, and how to select the right inflatable for your event.

Why Bounce House Rentals Are a Must-Have for Tampa Events

Tampa’s warm climate and vibrant community make outdoor parties a year-round favorite. Bounce House Rentals add instant excitement and energy to any occasion while keeping kids and adults entertained.

Key Benefits of Bounce House Rentals

- Encourage physical activity and movement

- Provide safe, supervised entertainment

- Suitable for all types of events and age groups

- Easy setup and takedown by professionals

- Cost-effective party entertainment

Bounce houses are not just fun—they’re also a practical solution for keeping guests engaged without the need for constant planning or supervision.

A Wide Variety of Bounce House Options to Choose From

One of the biggest advantages of renting from Bounce Party of Tampa is the extensive selection of bounce house options available. No matter the size of your event or the age group of your guests, there’s an inflatable that fits your needs.

1. Classic Bounce Houses

Traditional bounce houses are a timeless party favorite. These colorful inflatables offer plenty of space for jumping, bouncing, and laughing. They’re perfect for:

- Birthday parties

- Backyard gatherings

- Family celebrations

2. Themed Bounce Houses

Make your party even more memorable with themed bounce houses. Popular themes include:

- Princess castles

- Superheroes

- Jungle and animal themes

- Sports-themed inflatables

Themed bounce house options are especially popular for kids’ birthdays and school events.

3. Combo Bounce Houses

Combo units combine bouncing areas with slides, climbing walls, or basketball hoops. These multi-feature inflatables provide more entertainment in one unit, making them ideal for larger groups.

Benefits of combo bounce houses:

- Multiple activities in one inflatable

- Keeps kids engaged longer

- Great value for extended events

4. Water Bounce Houses and Wet Combos

Perfect for hot Tampa days, water bounce houses add a refreshing twist to traditional inflatables. These options often include:

- Water slides

- Splash pools

- Sprinkler systems

Water bounce house rentals are a summer favorite and ideal for outdoor parties.

5. Obstacle Courses and Interactive Inflatables

For older kids, teens, and even adults, obstacle courses and interactive inflatables bring friendly competition and excitement.

Popular uses include:

- School field days

- Corporate team-building events

- Community festivals

How to Choose the Right Bounce House for Your Event

With so many bounce house options available, selecting the right one can feel overwhelming. Here are a few key factors to consider:

Event Size and Guest Count

- Smaller gatherings: Classic bounce houses

- Medium-sized parties: Combo units

- Large events: Multiple inflatables or obstacle courses

Age Group of Participants

- Toddlers and young kids: Smaller bounce houses

- Older kids and teens: Combos or obstacle courses

- Mixed ages: Multi-feature inflatables

Space and Location

Measure your available space to ensure the inflatable fits comfortably. Bounce Party of Tampa can help you select a bounce house that matches your venue size.

Theme and Occasion

Matching your inflatable to your party theme enhances the overall experience and creates a cohesive look.

Safety and Cleanliness You Can Trust

Safety is a top priority when it comes to Bounce House Rentals. Bounce Party of Tampa follows strict safety and sanitation standards to ensure peace of mind for parents and event organizers.

Our Safety Commitment Includes:

- Thorough cleaning and sanitization after every use

- Regular inspections and maintenance

- High-quality, commercial-grade inflatables

- Secure setup by trained professionals

With professional installation and proper anchoring, you can relax knowing your guests are enjoying safe and reliable entertainment.

Perfect for Any Occasion in Tampa

Bounce houses are incredibly versatile and suitable for a wide range of events, including:

- Birthday parties

- School and daycare events

- Church functions

- Corporate events

- Neighborhood block parties

- Fundraisers and festivals

No matter the event, Bounce House Rentals create a fun, energetic atmosphere that guests remember long after the party ends.

Why Choose Bounce Party of Tampa?

Bounce Party of Tampa is a trusted local provider known for exceptional service and premium inflatables. When you rent with us, you get:

- A wide selection of bounce house options

- On-time delivery and professional setup

- Friendly, knowledgeable customer service

- Competitive pricing with no hidden fees

We understand Tampa events and work hard to ensure your celebration runs smoothly from start to finish.

Book Your Bounce House Rentals Today

If you’re ready to elevate your next event, Bounce House Rentals from Bounce Party of Tampa are the perfect solution. With a variety of exciting bounce house options, exceptional service, and a commitment to safety, we make party planning easy and stress-free.

Frequently Asked Questions (FAQs)

1. How far in advance should I book bounce house rentals?

It’s best to book at least 1–2 weeks in advance, especially during weekends and peak party seasons in Tampa.

2. Are bounce houses safe for young children?

Yes. We offer age-appropriate bounce house options and ensure all inflatables are professionally installed and inspected.

3. Do you provide delivery and setup?

Absolutely. All Bounce House Rentals include professional delivery, setup, and takedown.

4. Can bounce houses be set up on grass or concrete?

Yes. Our inflatables can be safely installed on grass, concrete, or other flat surfaces with proper anchoring.

5. What happens if the weather is bad?

If weather conditions are unsafe, we work with customers to reschedule or provide flexible options whenever possible.

FINANCE

Why AML Risk Intelligence Matters More Than The 2028 Deadline

AML used to sit quietly in the background of the investment adviser playbook. That period is ending fast. FinCEN’s 2024 final rule shifts many SEC registered RIAs and exempt reporting advisers into the Bank Secrecy Act definition of “financial institution.” This brings full AML and CFT responsibilities, including SAR filing, recordkeeping, and independent testing.

FinCEN later proposed shifting the effective date from January 1, 2026 to January 1, 2028. The change only affects timing. It does not reduce expectations. The rule is still broad, still mandatory, and still focused on building stronger national security safeguards through the investment advisory sector.

At the same time, enforcement activity continues to climb. Global AML fines reach into the billions every year, and North American firms are often among the most heavily penalized. Some cases reach hundreds of millions for a single institution.

For RIAs, the message is clear. AML is not a side task. It is a core part of risk, revenue protection, and firm reputation. Advisers that treat the 2028 date as a distant formality will find themselves scrambling while clients, auditors, and regulators ask hard questions.

What Is AML Risk Intelligence For RIAs And Wealth Managers?

AML risk intelligence describes how a firm uses data, people, and technology to understand financial crime exposure in context. Instead of only reacting to rule based alerts, risk intelligence asks deeper questions:

- How risky is this client or product in the current environment?

- Does this pattern match what we know about the client or their peer group?

- Are there links to high risk jurisdictions or counterparties?

- What story would this data tell if an examiner reviewed it tomorrow?

For RIAs, strong AML risk intelligence usually includes:

- A documented risk assessment aligned with strategy and offerings

- A unified view of clients, entities, and fund flows across custodians

- Monitoring that uses both rules and behavioral analytics

- SAR processes that staff understand and use confidently

- Governance that connects AML to board oversight and investment decisions

With these in place, AML shifts from being a burden to acting as an early warning radar for issues that can harm clients or disrupt operations.

How FinCEN’s Investment Adviser AML Rule Raises The Baseline

The final rule is not intended to convert RIAs into banks, but it does set a new minimum standard across the advisory landscape.

Who is covered

FinCEN’s rule applies to:

- SEC registered RIAs with more than 110 million dollars in assets under management

- Exempt reporting advisers that file with the SEC, including many private fund advisers

These firms now fall clearly inside the BSA perimeter and must build AML and CFT programs.

Regulatory expectations

Covered firms must implement:

- A risk based AML and CFT program

- A designated AML officer with real decision making authority

- Ongoing training for relevant staff

- Independent testing

- SAR filing

- Recordkeeping that supports law enforcement requests

The 2028 date provides time, but it is meant for structured planning, not procrastination.

Flagright’s guide on the FinCEN AML rule for RIAs explains how the rule works, how penalties apply, and why firms that wait until the last minute face significant exposure in both operations and enforcement.

Why Investors Now Care Deeply About AML Controls

AML has moved into the spotlight for allocators, consultants, and wealth clients. Several forces explain this shift.

High profile failures

Major leaks and investigations in recent years revealed how trusted institutions processed suspicious flows for long periods without intervention. These stories raised questions about culture and governance across the financial sector.

Growing fine totals

AML and sanctions penalties continue to rise. Even when firms survive financially, they face:

- Loss of trust

- Harder fundraising conditions

- Higher compliance costs for years

Link between AML and governance

Investors now treat AML as a pillar of good governance rather than a narrow regulatory concern. Poor controls signal weak oversight and higher operational risk.

Advisers who can clearly explain their risk assessment, SAR process, and monitoring technology stand out. Vague claims about following “industry standards” no longer satisfy allocators.

Where Traditional RIA Controls Fall Short

Many RIAs rely on partial or outdated controls. Under the new rule, these gaps become obvious.

1. Static policies not matched to real activity

Some policies change only during due diligence cycles. They may not reflect current clients, jurisdictions, custody structures, or products. Regulators expect a direct link between written policy and daily practice.

2. One time onboarding checks

Some firms collect KYC information once, store it, and never update it. Risk based programs require ongoing updates when:

- Ownership changes

- New jurisdictions appear

- Negative media increases

- Transaction behavior shifts

Static KYC files cannot support ongoing monitoring.

3. Spreadsheet based monitoring

Manual spreadsheets break fast when:

- Firms use multiple custodians

- Strategies involve frequent cross border movements

- Client structures include several layers

Modern platforms such as Flagright support unified monitoring, screening, and case management so RIAs no longer rely on scattered tools or manual trackers.

4. Weak governance tone

When AML is treated as a cost center, problems appear:

- Escalations slow down

- Budget requests are ignored

- Compliance sits far from investment committees

Regulators consider weak governance a sign of serious risk.

How AI And Automation Transform AML For RIAs

AI is not abstract for RIAs. It creates very practical advantages.

Smarter monitoring

AI models analyze historical and peer behavior, detecting patterns such as:

- Transfers timed just below thresholds

- Sudden activity spikes not linked to portfolio events

- Unexpected routes through high risk jurisdictions

This reduces false positives and surfaces higher quality alerts.

Dynamic client risk scoring

Instead of a static rating, dynamic scoring updates as new signals appear:

- PEP exposure from a new director

- Negative media about an owner

- Shifts in transaction geography

Monitoring rules adjust automatically as risk changes.

Faster investigations and SAR workflows

AI tools can:

- Merge related alerts into a single case

- Pre fill relevant details

- Suggest common typologies

- Shorten review cycles

Flagright provides AI-driven AML compliance solutions that help RIAs stay exam ready even with lean compliance teams. Their platform unifies monitoring, screening, and case management in a central environment that reduces workload and strengthens documentation. Many RIAs evaluating upgrades pair these capabilities with financial compliance software to create standardized workflows and stronger control frameworks that scale with growth.

Key Questions RIAs Should Answer Before 2028

What happens if an adviser reaches 2028 without a real AML program?

FinCEN can impose civil money penalties for willful BSA violations. The SEC may add sanctions if disclosures are misleading or risks are ignored.

How long does it take to build a functional AML program?

A realistic timeline includes:

- Several months for risk assessment and program design

- Several more for data mapping and technology integration

- Ongoing cycles of training and independent testing

Do smaller advisers need bank level systems?

Expectations are proportional, but all firms need:

- A risk based program

- Reliable screening

- Basic monitoring

- Clear escalation and SAR documentation

A Practical 12 To 18 Month AML Roadmap

Phase 1: Assess and design (first three months)

- Map client types, business lines, and flows

- Identify higher risk areas

- Document gaps

- Create a risk based framework

- Gain senior leadership approval

Phase 2: Data and tools (next six months)

- Map core data sources

- Fix key inconsistencies

- Choose technology

- Centralize case management

- Build early dashboards

Phase 3: Training and dry runs (months ten to eighteen)

- Train teams with real scenarios

- Run mock investigations

- Test SAR preparation

- Invite independent reviewers

By the end, staff should be confident and exam ready.

Turning AML Readiness Into An Investor Story

Stronger AML controls can strengthen fundraising and retention. Practical methods include:

- Adding an AML section to RFP materials

- Offering a walkthrough of the risk model

- Sharing high level results from independent tests

- Showing links between AML, cyber, and governance

Investors do not expect zero risk. They expect clarity, consistency, and honesty.

The Strategic Advantage Of Starting Now

The years leading up to 2028 offer a unique window. RIAs that move early will:

- Build stronger operational foundations

- Avoid rushed deployments

- Reduce future exam pressure

- Strengthen trust with investors

- Prevent surprises once enforcement tightens

AML readiness is not only about compliance. It is about stability, credibility, and long term growth. RIAs that build true AML risk intelligence now will lead the next chapter of the advisory industry with confidence.

HOME

Sustainable Ways to Keep Carpets Fresh and Clean

Keeping carpets fresh, clean, and environmentally friendly doesn’t have to be a challenge. With conscious choices and everyday habits, you can preserve the comfort and beauty of your home’s carpets while reducing your ecological footprint. Establishing consistent care routines is not only beneficial to health but also essential for extending the life of your carpets and lowering replacement costs. Sustainable carpet cleaning practices are now more accessible than ever, making it easier to protect both your home and the planet.

Clean carpets contribute significantly to indoor air quality and the overall wellness of your living space. By choosing eco-friendly approaches, you prevent harsh chemicals from entering your home environment and the water system. Additionally, routine cleaning helps prevent allergens from accumulating, which is especially crucial for families with children or pets.

Adopting green strategies for carpet maintenance doesn’t compromise cleanliness. Many natural products and modern technologies are equally, if not more, effective than traditional methods. Small, gradual changes in your daily habits can add up, keeping carpets vibrant, soft, and odor-free.

Besides carpets, upholstery often faces similar wear and exposure to dust, allergens, and spills.

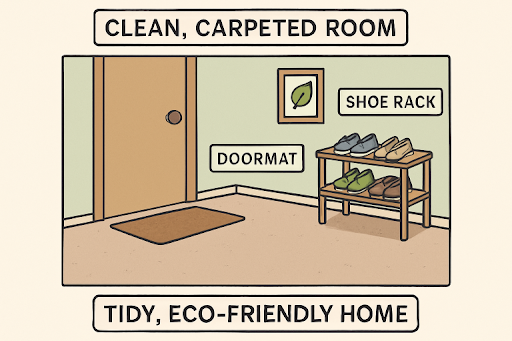

Adopt a No-Shoes Policy Indoors

Instituting a no-shoes policy is a simple way to minimize the dirt, grime, and pollutants carpets collect. Shoes are major carriers of outdoor debris, pesticides, and bacteria—all of which become trapped in carpet fibers and can degrade air quality. Regular upholstery cleaning complements this effort by ensuring that sofas, chairs, and other fabric surfaces remain free of dust, allergens, and lingering contaminants, creating a healthier indoor environment. To make this policy easy for everyone, provide a dedicated shoe storage area near the door and offer comfortable slippers for guests.

Vacuum Regularly with HEPA Filters

Routine vacuuming is essential for arresting the buildup of dust, allergens, and pet dander in carpets. Prioritize vacuums equipped with HEPA filters, which trap particles as small as 0.3 microns, preventing them from circulating in the air. Experts at WebMD recommend vacuuming high-traffic areas at least twice weekly and using slow, overlapping strokes for thorough cleaning. This practice not only maintains cleanliness but also protects household members with allergies or respiratory concerns.

Utilize Natural Cleaning Agents

For odor control and stain removal, natural cleaning solutions are both safe and effective. Baking soda, when sprinkled on carpet and left to sit before vacuuming, neutralizes odors and absorbs moisture. For spills and stains, a mixture of white vinegar and water offers decisive antibacterial action without leaving toxic residues. The Environmental Working Group (EWG) encourages homemade cleaning solutions as safer alternatives that prevent unnecessary chemical exposure and support long-term carpet integrity.

Schedule Professional Eco-Friendly Cleanings

Even with routine care, professional deep cleaning is vital for removing embedded dirt and stubborn stains. Seek out cleaning services that use environmentally conscious methods such as hot water extraction or plant-based, biodegradable solutions. Regular professional treatments—recommended once or twice a year—extend the appearance and lifespan of your carpet and provide a thorough level of cleanliness that’s difficult to achieve with home methods alone.

Implement Protective Measures

Defensive steps, such as installing high-quality doormats at all home entrances and using area rugs in busy walkways, can make a big difference. Doormats trap extra dirt and grit before it ever reaches your carpet, while area rugs protect large carpeted areas from heavy wear and tear. Be sure to clean and shake out these mats and rugs regularly, as a dirty mat is less effective and can even contribute to the problem rather than prevent it.

Address Spills Promptly

A quick response to spills is crucial to prevent permanent staining and to inhibit the growth of mold or bacteria. Blot spills immediately—never rub—with a clean, dry cloth, then follow up with an appropriate cleaning solution. For food or drink stains, a combination of mild dish soap and water usually suffices. Always test homemade solutions in an inconspicuous area first, especially for colorful natural fibers.

Choose Sustainable Carpet Materials

When it’s time to replace carpets, opt for environmentally friendly alternatives. Wool, recycled polyester, jute, and seagrass are durable, renewable, and naturally resistant to staining and odors. Check that new carpets are colored with non-toxic dyes and support indoor air quality certifications such as Green Label Plus or OEKO-TEX, which indicate minimal emissions of volatile organic compounds (VOCs). Sustainable choices at the point of purchase set the stage for a healthier home for years to come.

Maintain Proper Ventilation

Moisture accumulation can quickly render even the cleanest carpets musty and prone to mold. Open windows when the weather allows and use fans or dehumidifiers to maintain airflow and reduce humidity, particularly in basements or bathrooms adjacent to carpeted areas. Make sure exhaust fans are functioning efficiently to support both carpet and air quality.

By integrating these sustainable practices, you’ll enjoy clean carpets that support a safer, fresher, and more environmentally responsible home.

-

HEALTH2 years ago

HEALTH2 years agoIntegrating Semaglutide into Your Weight Loss Plan: A Practical Guide

-

HOME IMPROVEMENT2 years ago

HOME IMPROVEMENT2 years agoHow to Choose the Perfect Neutral Area Rug for Every Room

-

LAW2 years ago

LAW2 years agoTeenage Drivers and Car Accidents in California: Risks and Parental Liability

-

CONSTRUCTION2 years ago

CONSTRUCTION2 years agoConstruction Site Safety Regulations in New York and Your Rights as a Worker

-

LAW2 years ago

LAW2 years agoPost-Divorce Considerations in California: Modifications and Long-Term Planning

-

FASHION2 years ago

FASHION2 years ago7 Celebrity-Inspired Elegant Summer Dresses For 2024

-

HOME2 years ago

HOME2 years agoSandra Orlow: The Teen Model Who Captivated the Internet

-

FINANCE2 years ago

FINANCE2 years agoDigital Asset Management in Florida Estate Planning